Where B.C. employment has (and hasn’t) grown since 2019

British Columbia’s job market has changed notably since 2019. Most of the province’s net new jobs since January 2019 have been concentrated in services-producing sectors, with a disproportionate share of that growth occurring in the public sector. At the same time, many of B.C.’s high-productivity, export-generating industries have seen little or no job growth.

Goods-producing sectors have been left behind

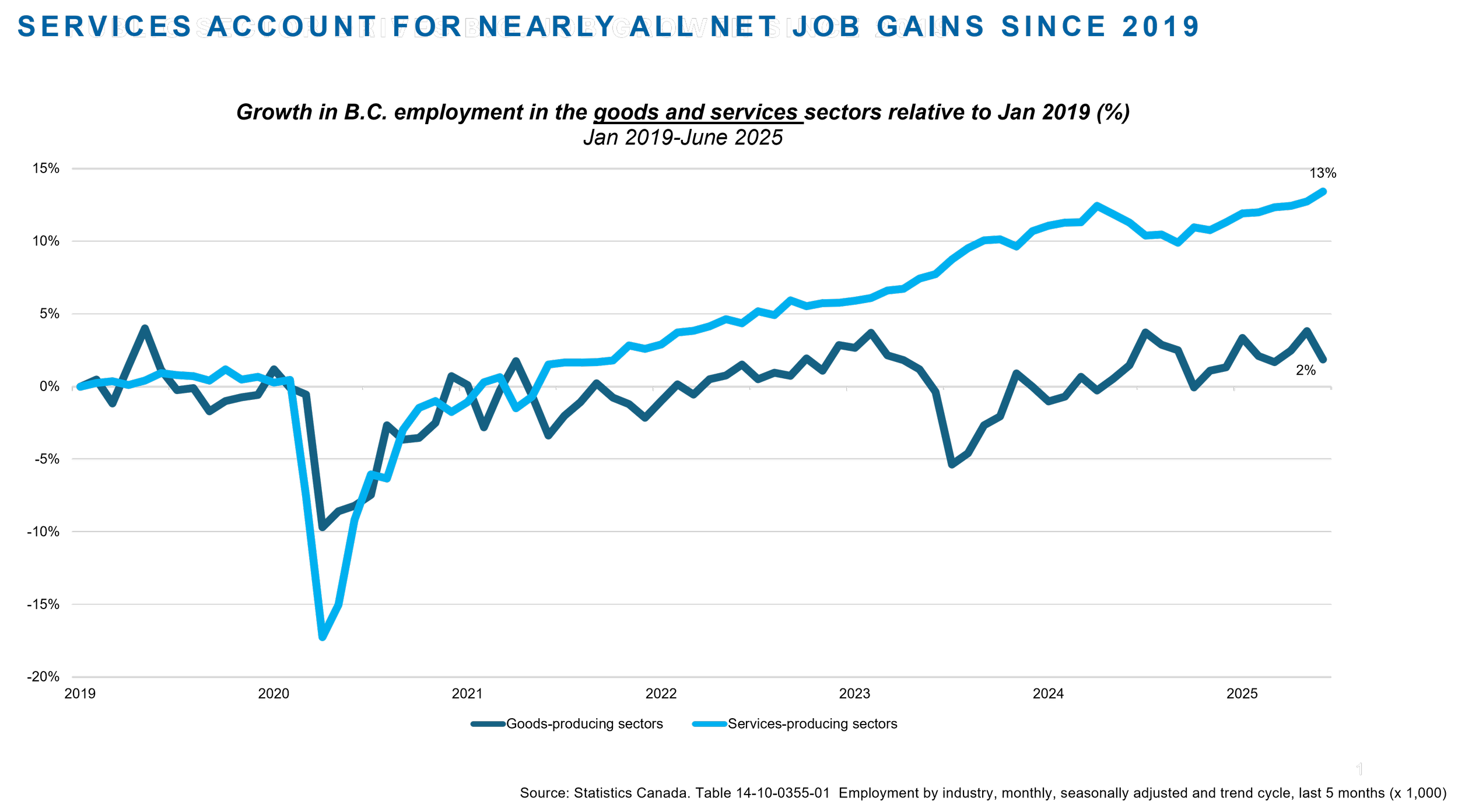

Since January 2019, employment in B.C.’s services-producing sectors (e.g., healthcare, education, professional, finance, etc.) has grown by 13%, compared to just 2% growth in goods-producing sectors (Figure 1).

Figure 1

The goods-producing sectors’ share of total employment has declined from 19% to 17% in the last six years. Conversely, services-producing sectors’ share of total employment have increased from 81% to 83% over the same period.

Public sector hiring is booming

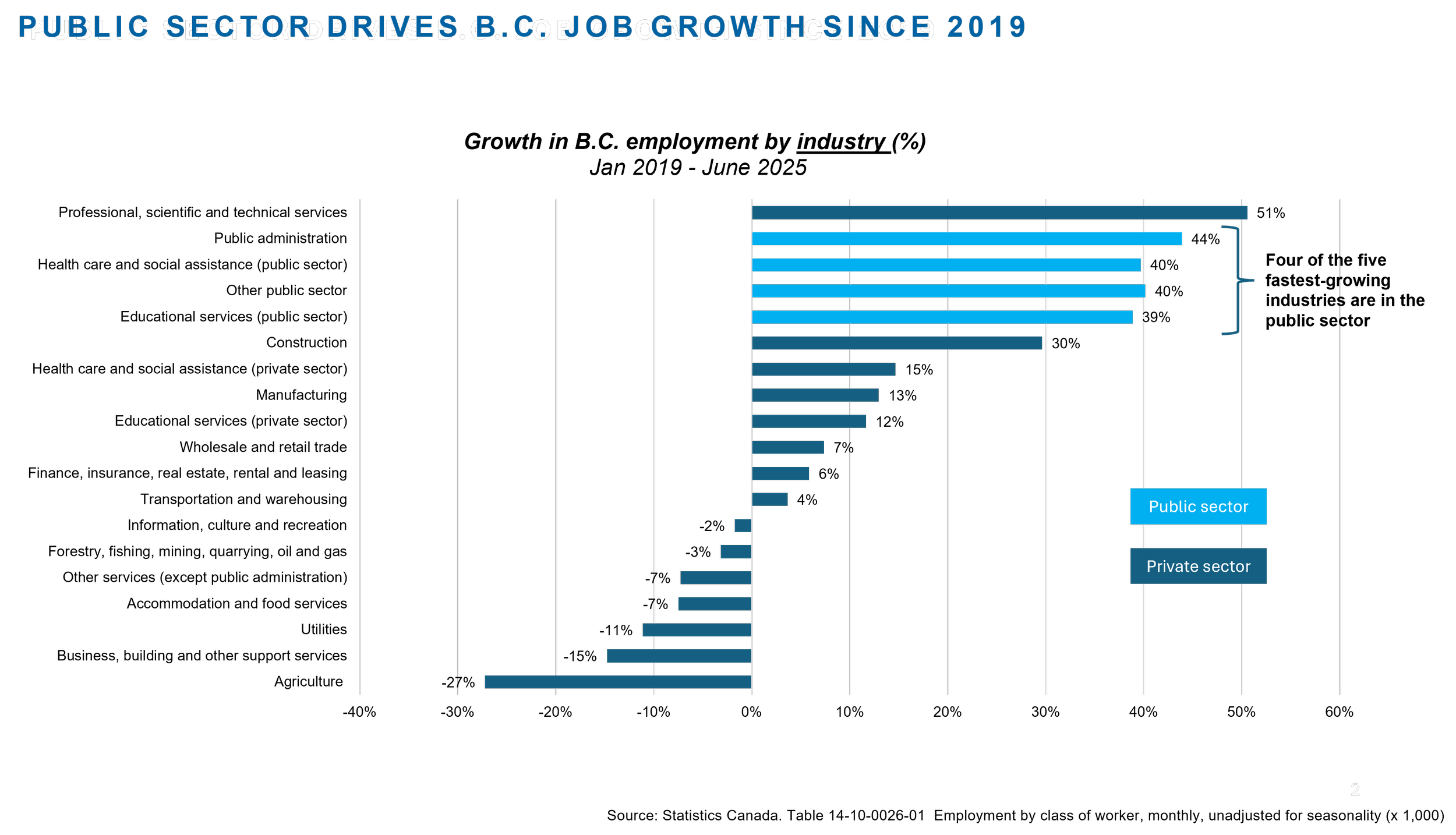

A closer look at job growth by industry shows that four of the five fastest-growing industries, in terms of employment growth, are in the public sector (Figure 2). There have been massive increases in employment since January 2019 in public administration (44%), public health care and social assistance (+40%), public educational services (+39%), and other public sector jobs (+35%).1

It is important to note that jobs in the public sector typically grow in line with population and service demand. But in recent years, growth has accelerated well beyond historical norms. Public administration grew the most compared to its historical trend, rising at nearly three times its long-term (1987-2024) growth rate. Public sector health care and education jobs grew at more than double (2.3 times) their typical pace over the last five years (see Yunis, 2025).

Figure 2

The only private sector industry in the top five is professional, scientific and technical services. Employment in this sector has increased significantly by 51% since 2019. Its share of total private sector jobs rose from 9% in January 2019 to 12% by June 2025, making it now the second largest source of private employment in the province after wholesale and retail trade. The sector includes a wide range of services such as legal, accounting, engineering, architecture, consulting, and scientific research.

Elsewhere across the private economy, job growth has been weak or negative. Sectors such as retail, finance, insurance, real estate and leasing, and transportation have seen only modest gains. Other industries like information, culture and recreation, business support services, accommodation and food services, and utilities have experienced outright declines.

B.C.’s resource-based export sectors are struggling

Nowhere is the private-sector employment weakness more concerning than in the resource-based sectors that form the backbone of B.C.’s exports. Agriculture stands out as the hardest-hit industry, with a 27% drop in employment since January 2019. Employment in the utilities sector is down 11% during the same period. Jobs in forestry, fishing, mining, and oil and gas have declined by about 3%.

These trends are concerning because they represent jobs in high-productivity industries that generate significant export revenues. Those revenues support regional economies and circulate through the domestic economy more generally. They help pay for imports of goods and services while providing tax revenues to fund public services. As the economic footprint of resource-based sectors shrinks, so too does the province’s ability to sustain income growth and fiscal strength.

Conclusion

Over the last six years, B.C.’s labour market has tilted heavily toward job creation in the public sector and professional services. Job growth in high-productivity, export-oriented sectors has been weak. Unless hiring picks up in B.C.’s key export industries and the private sector writ large, the province’s public sector hiring spree appears fiscally unsustainable.